Investment Intelligence: Q1 2025 Active Deal Pipeline Insights

Investment Intelligence: Q1 2025 Active Deal Pipeline Insights

Explore the latest insights from DCA Asset Management’s updated deal pipeline, offering a comprehensive overview of the firm’s Q1 2025 investment data.

In a quarter marked by heightened AI valuations and continued SAFE note proliferation, DCA harnesses its precision-focused analytics to cut through market noise and identify standout opportunities for its clients.

Active Deal Pipeline

Q1’25 Deal Spotlight

In Q1’25, DCA screened 155 deals that met the firm’s initial investment benchmarks, representing a significant increase of 37% quarter-over-quarter (+42 deals). This continued growth reflects the enhancement of DCA’s revamped scouting and deal-sourcing processes, demonstrating the firm’s commitment to identifying promising investment opportunities across a diverse range of sectors and stages.

A High-Level Look at Q1 2025

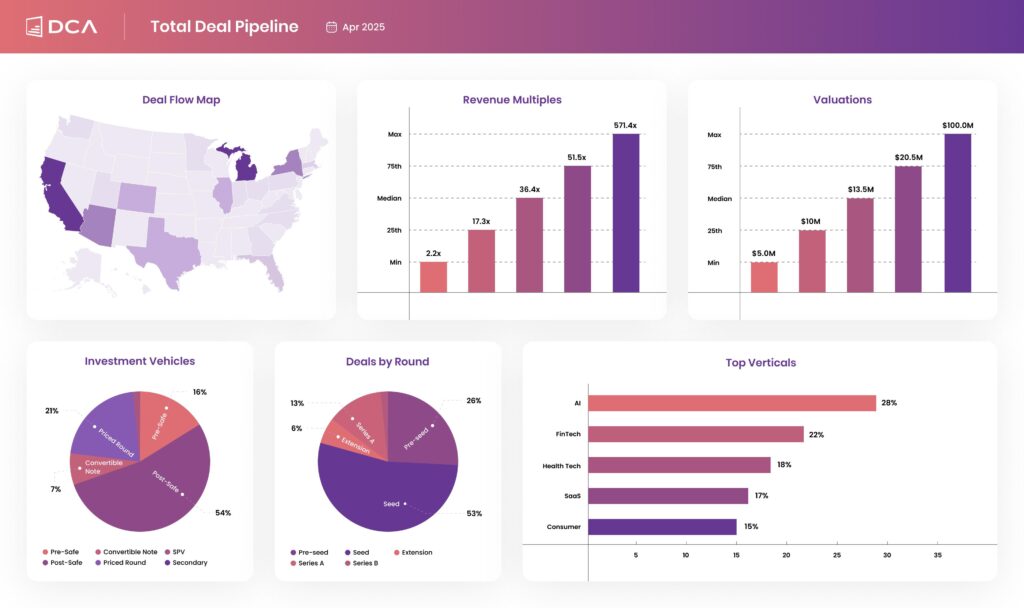

Of the 750+ deals sourced in Q1’25, the geographical distribution remained diverse, with representation across 41 different states and 23 countries. California (14.5%) and Michigan (16.4%) emerged as the leading hubs, together accounting for nearly a third of all screened deals. New York (10.9%), Arizona (9%), Illinois (4.6%), and Texas (4.4%) followed as the next most active regions. This broad geographical spread underscores DCA’s geography-agnostic investing strategy and strong co-investor network.

Investment Vehicles: SAFE Notes Continue to Dominate

Q1’25 saw a further increase in SAFE notes usage, with approximately 70% of screened deals utilizing this investment vehicle. This trend reflects the growing comfort with SAFEs in the early-stage VC market, driven by their cost-effectiveness and accessibility for founders raising smaller rounds. The introduction of side letters into many deals (MFN clause, pro rata, etc.) also contributed to investors’ comfort with larger dollar amounts raised on SAFEs.

However, DCA maintains a nuanced perspective, carefully considering the inherent risks of SAFEs, including:

- Lack of investor rights protection in future priced rounds

- Absence of formal governance structure

- Cap table complexity and investor perception challenges when raising multiple SAFE rounds at different valuations

Verticals: AI and Fintech Maintain Leadership

AI continued as the dominant vertical in Q1’25, representing 28% of screened deals, followed closely by Fintech at 22%. HealthTech (18%) and SaaS (17%) rounded out the top segments. This distribution spans 25 different verticals, highlighting DCA’s broad yet focused approach to identifying opportunities across its target sectors.

Valuation: Modest Growth in Valuations and Multiples

The median valuation of screened deals in Q1’25 increased to $13.5M, representing a 6% growth quarter-over-quarter. More notably, the median EV/Rev multiple increased 17% quarter-over-quarter to 36.4x. This slight increase in valuation metrics was primarily driven by an increased number of AI deals and larger rounds commanding higher valuations.

Funding Stages: Continued Focus on Seed Investments

Q1’25 deal flow remained concentrated in the Seed and Seed Extension stages, comprising 59% of screened deals. Pre-seed opportunities represented 26% of deal flow, while Series A+ rounds accounted for 15%. This distribution aligns with DCA’s strategic focus on early-stage investments while maintaining flexibility across the investment spectrum.

Data-Driven Deal Analysis

DCA Asset Management continues to refine its investment approach through robust data analysis and strategic deal sourcing. The significant increase in screened deals, combined with the firm’s expanding geographical reach and sector diversity, underscores DCA’s commitment to identifying high-potential opportunities across the early-stage venture landscape.

—

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this post reflects the personal opinions, viewpoints, and analyses of the DCA employees providing such comments, and should not be regarded as the views of DCA Asset Management or its respective affiliates or as a description of advisory services provided by DCA or performance returns of any DCA clients.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.