Investing in AI-Based Technologies: From Hype to Substance

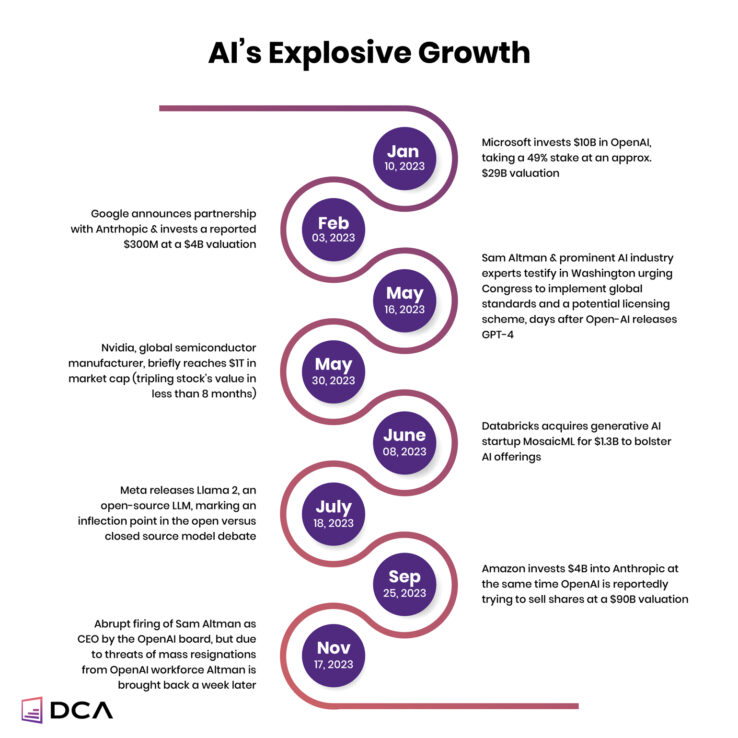

Since the launch of ChatGPT in November 2022, the landscape of artificial intelligence (AI) has undergone a seismic shift with widespread adoption and implementation. ChatGPT made history as the fastest-growing app, amassing over 100 million users within its first two months—a testament to the transformative impact AI is having on our daily lives, comparable to the advent of the internet.

Key statistics below underscore the immense potential of AI applications:

- The AI market is projected to reach $1.3 trillion by 2030, with a 36.8% 8-year CAGR.

- AI is expected to contribute to a 21% increase in the United States GDP by 2030.

- By 2030, one in 10 cars is anticipated to be self-driving.

- 64% of businesses foresee AI enhancing productivity.

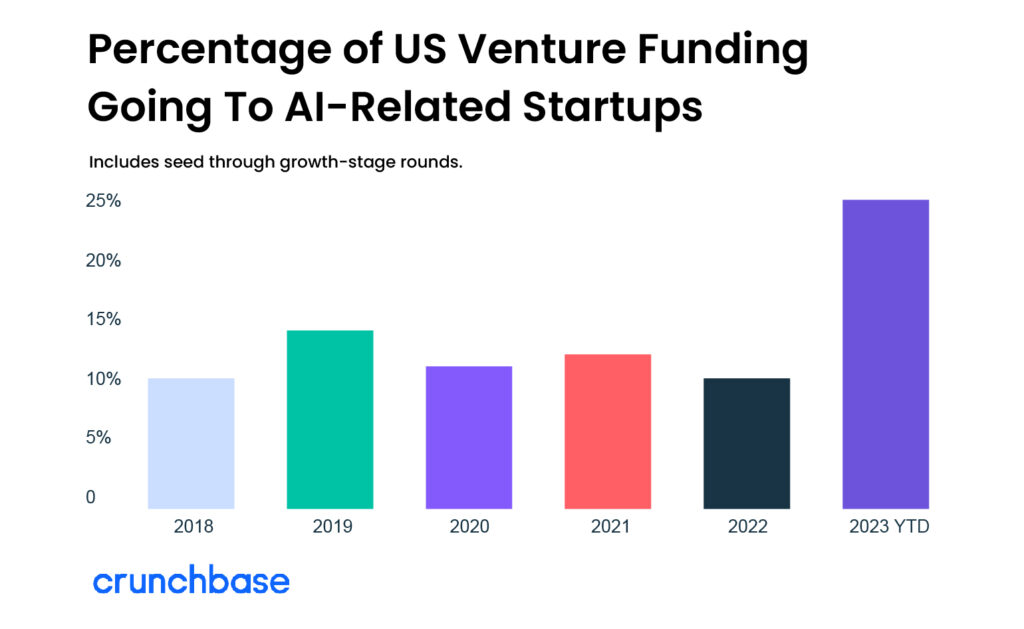

Bringing AI’s unprecedented growth into the context of startups and VC, 2023 saw a dramatic increase in startup innovation and venture funding. In 2023, more than one in four dollars invested in American startups went to AI startups, reflecting the bullish expectations the sector boasts today.

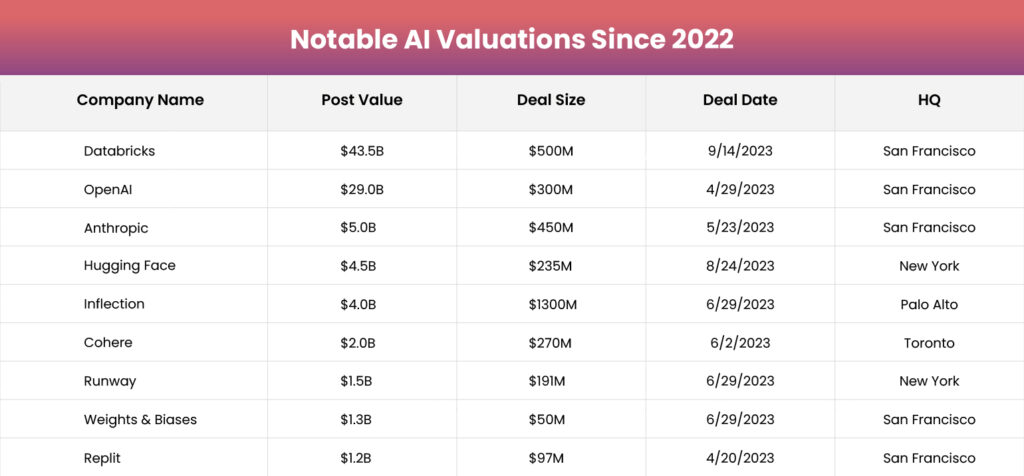

The heightened demand for AI applications has created a unique environment, insulating the valuation of emerging AI startups amidst the broader venture capital market downturn. Notably, Mistral, a French AI startup founded by ex-Google and ex-Meta AI researchers, secured a remarkable $414 million Series A round at a $2 billion valuation—a staggering 672% increase from their seed round announced just six months earlier.

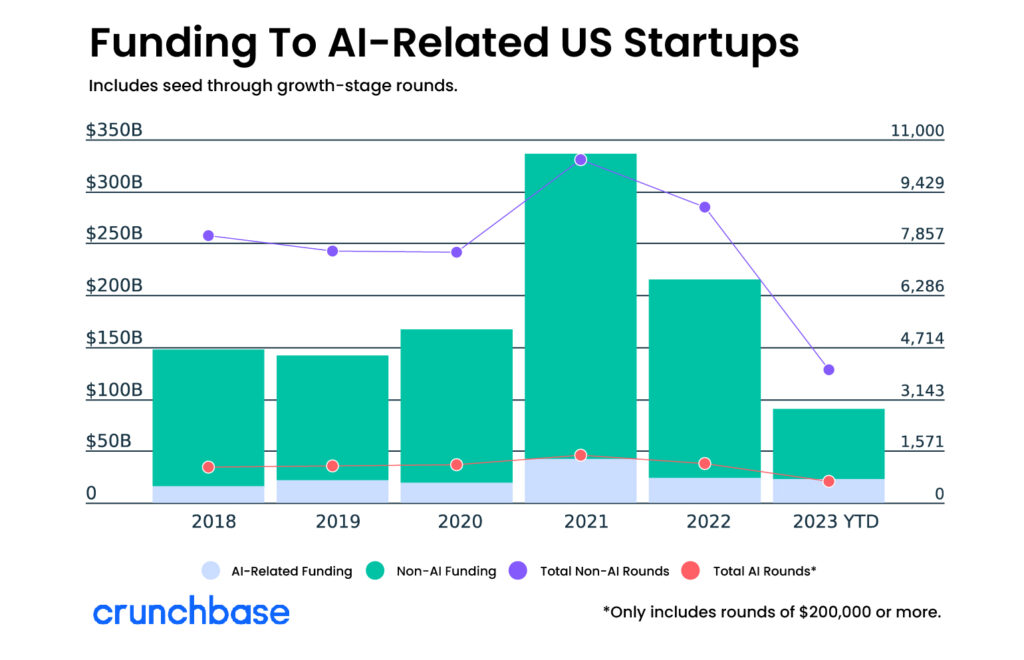

There is no denying AI’s growth and massive potential, it is important as an investor to separate signals from noise in any hype cycle. While there has been a dramatic increase in AI startups & applications coming to market, the majority of the industry’s VC investments were driven by a few large deals.

Despite the majority of AI VC funding in 2023 flowing to a handful of prominent AI startups, the vast landscape of AI startups and applications extends beyond these major players. Within this void, there are significant opportunities for investors, particularly those in the early stages.

As early-stage investors, it is an exciting time to be deploying capital at the onset of this generation-defining technology. However, amidst the ongoing AI hype cycle, it is crucial for investors to develop clear theses on where sustainable value will accrue. While there is an abundance of quality AI startups, the current market is also littered with undifferentiated AI applications supported by non-defensible APIs, wrappers, and unscalable backend infrastructure. Herein lies the challenge for investors to develop and lean on their theses and core investing principles.

At DCA, we take pride in detailed market research and thorough diligence. Our team continually refines our AI vertical theses through our market research and diligence from our own AI portfolio companies.

In addition to DCA’s market research and internal diligence, our 2023 deal pipeline was marked by the highest volume of AI deals ever. Through our deal flow analysis, market research, and internal diligence, our team has identified five core signals for quality early-stage AI investments:

-

- Proprietary Datasets: Leveraging proprietary datasets to train models in industry complexities and generate more accurate results that can solve real-world problems versus generic, untrained models. Training AI models on proprietary datasets is especially critical in technical industries such as healthcare, manufacturing, and finance where there is no room for inaccuracy or model hallucinations.

- Intuitive Self-Serve UX: AI startups with user-friendly interfaces broaden their market reach, attracting and retaining users with varying levels of technical ability. Accessible UX also increases user engagement, generating valuable customer data for AI startups to utilize for product improvements. Additionally, AI startups that offer self-serve and frictionless user experiences save money and extend runway by decreasing customer support and implementation costs as they scale.

- Verticalization & Embedded Workflows: Verticalization is key for AI startups to stand out amid the masses of generic AI applications and increased competition. Tailoring products to specific use cases and industry-specific data fosters a stronger product-market fit and ensures more effective long-term scalability.

- Hyper-Personalized Data, UI, and UX: Personalized and custom user experiences can enhance customer engagement, increase conversion rates, and ensure lower customer churn. Personalization in AI applications is pivotal for better retention and efficient product scale.

- At Least One Technical Founder: Having at least one technical founder accelerates product iteration, especially in a startup’s earlier stages. This facilitates effective communication between customer feedback and product iteration, resulting in more efficient development and reduced reliance on third-party technical advisors.

While we are not AI technical experts, our team at DCA acknowledges that the above signals will continue to evolve. These signals stem from both our internal research and diligence with our own AI portfolio companies.

We believe now is an exciting time to be an investor in emerging AI technologies as the industry experiences an unprecedented rate of innovation and an influx of technical talent. While 2023 was a benchmark year for AI technology, 2024 holds immense potential from both an operator and investor perspective. Key trends in the AI market that DCA is tracking in 2024 are:

- Continued dominance of AI and Data in the VC Fundraising Landscape

- Heightened M&A Consolidation of AI Startups and Technology

- AI-Enabled Search Functionality

- More practical AI solutions coming to market

We believe this is an opportune time for investors in emerging technology as AI continues to permeate our everyday lives and processes. Despite the noise and the current hype cycle the AI industry boasts, investing from first principles remains imperative to discern meaningful signals in this evolving AI industry.

Sources

- Forbes AI Statistics

- Gen AI Deal Count

- Gen AI Valuations

- 1 in 4 American Startups Fact

- Mistral Funding History (Seed + Series A)

- 2023 Key AI Events

—

*One of DCA’s guiding principles is that we will communicate with our investors and prospective investors as candidly as possible because we believe investors and prospective investors benefit from understanding our investment philosophy and approach. Our views and opinions regarding the prospects of investments and/or the economy are forward looking statements as defined under the U.S. federal securities laws, which may or may not be accurate and may be materially different over future periods. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will,” “may,” “should,” “plan,” or the negative of such terms and similar expressions identify forward looking statements. Forward looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from an investor’s historical experience and current expectations or projections indicated in any forward looking statements. These risks include, but are not limited to, equity securities risk, corporate bonds risk, credit risk, interest rate risk, leverage and borrowing risk, additional risks of certain investments, management risk, and other risks. We disclaim any obligation to update or alter any forward looking statements, whether as a result of new information, future events, or otherwise. You should not place undue reliance on forward looking statements, which speak only as of the date they are made.